2021 and Beyond: What Lies Ahead (Part 2)

The following is part two of a two-part series about the state of Canada’s foodservice industry. Part one reflected on the changes that occurred in 2020 due to COVID-19 and the lessons learned – read it here; part two looks at Restaurants Canada’s latest forecast for the foodservice industry for 2021 and beyond.

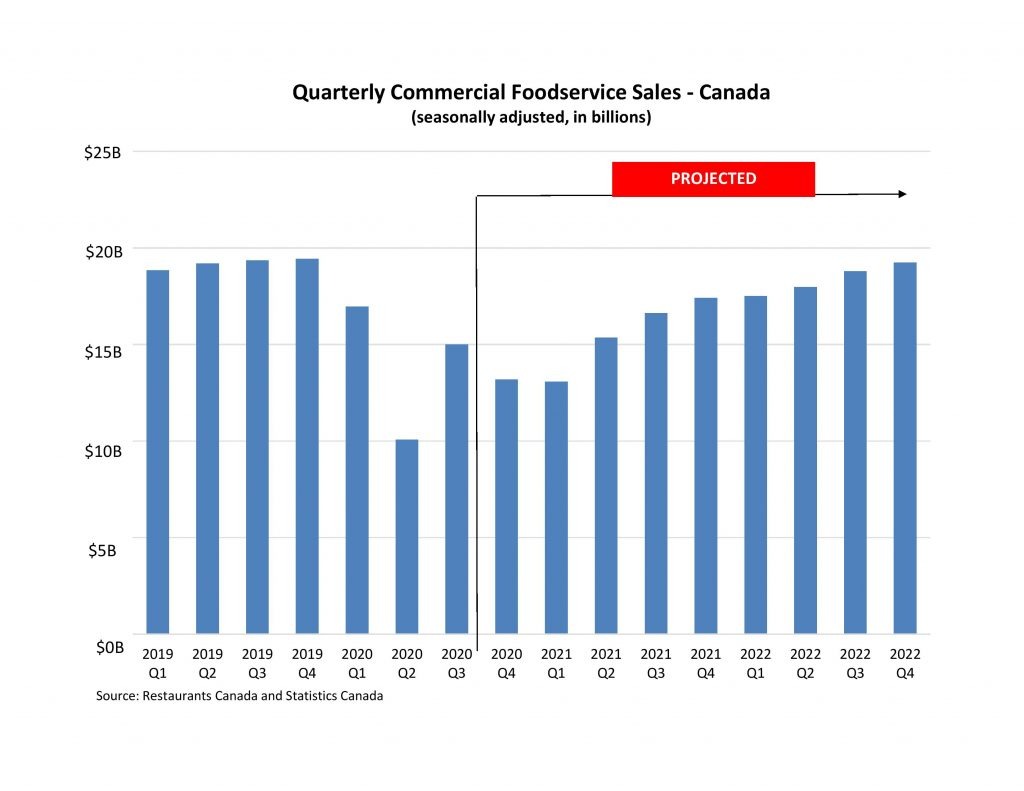

While the numbers for 2020 are not yet final, preliminary estimates indicate the pandemic crisis caused massive devastation to Canada’s foodservice industry. COVID-19 led to the closure of more than 10,000 foodservice establishments by the end of 2020, resulting in hundreds of thousands of lost foodservice jobs, and erasing more than $20 billion in commercial foodservice sales. Battered and bruised, where does the industry go from here in 2021 and beyond?

Forecasting Foodservice Sales

Restaurants Canada relies on several econometric models to forecast foodservice sales. Prior to COVID-19, fluctuations in employment, economic activity, demographics and disposable income had the largest effects on spending at restaurants and drinking places. The Canadian exchange rate also played a role, impacting the number of international visitors, domestic tourism spending and menu prices. These economic factors accounted for 98% of the total variation in foodservice spending. The model has since been updated to factor in the repercussions of COVID-19.

The future is clouded by two very big unknowns: current and/or future bans of on-premise dining (or lockdowns) across the country; and the timing of the vaccination rollout.

Short-term Outlook

The first quarter of 2021 will, sadly, be a repeat of what we witnessed in Q4 2020. With significant stay-at-home orders in Ontario, a curfew in Quebec and other provinces taking measures to limit the spread of COVID-19, foodservice sales in Canada are projected to fall by 22.9% in Q1 2021 on a year-over-year basis. As sales had already declined by 10% in Q1 2020, this will result in foodservice sales being 31% below Q1 2019 levels.

Overall, all segments are expected to see lower sales in Q1 2021 compared to Q4 2020, after adjusting for seasonal variation. Caterers and drinking places will be hardest hit: sales are forecast to drop by as much as 57% below pre-COVID-19 levels. Full-service restaurant sales will remain 45% below Q1 2019 levels. Although take-out and delivery will help quick-service restaurants relative to other segments, sales in Q1 2021 are projected to be 9% below Q1 2019 levels.

The Outlook for 2021

Thankfully, hope is on horizon. With the approval of the Pfizer-BioNTech and Moderna vaccines, Canadian health authorities estimate that most Canadians will be vaccinated by September 2021. This helps our forecasting timeline, as sales will steadily improve in the latter part of 2021 due to both the reduced risk of COVID-19 and pent-up consumer demand.

As a result, annual commercial foodservice sales are forecast to grow to $62.9 billion in 2021. While this represents an increase from the projected $55 billion in sales in 2020, Canada’s foodservice industry will remain 18.3% below 2019 levels, when sales were a record $77 billion.

In 2021, sales at quick-service restaurants are forecast to increase to $32 billion. While this represents a 9.5% increase over 2020, sales in 2021 will remain 5.1% below 2019 levels. Having experienced a 38.4% drop in sales in 2020, sales at full-service restaurants are forecast to climb to $25.3 billion in 2021 – a 19.4% increase over 2020. Still, sales will remain 26.2% below 2019 levels. For caterers and drinking places, the climb back will take even longer, as sales for both segments will remain more than 30% below 2019 levels.

The Outlook for 2022

In 2022, commercial foodservice sales in Canada are forecast to grow by 17.3%, rising to $73.8 billion. This will still not fully return the industry to pre-COVID-19 levels. Caterer and drinking place revenues are forecast to remain more than 10% below pre-COVID-19 levels in 2022, while sales at full-service restaurants will be down 7.5%.

Once a vaccine is widely administered, strong pent-up demand could lead to a faster-than-expected recovery in foodservice sales in the latter part of 2021 and into 2022. However, any reluctance to take the vaccine and/or a weaker-than-expected recovery in business dining and tourism will result in lower-than-expected sales in 2022 and postpone the recovery until 2023 or beyond.

For more information, look for the 2021-2025 Long Term Foodservice Forecast on Restaurants Canada’s member portal.

As the Senior Economist for Restaurants Canada, Chris Elliott manages and produces a comprehensive research program that has made Restaurants Canada a leading source of information for and about Canada’s $93-billion foodservice industry. Chris produces a number of member reports that analyze key industry trends and economic forecasts. Chris has worked with Restaurants Canada for 20 years, has a Bachelor of Arts and Master Degree in Economics and specializes in economic modeling and forecasting.

Join us at RC Show 2021 ‘Where do we go from here: COVID-19’s impact on foodservice & hospitality’ on Sunday, February 28, 9:00AM-9:55AM on the Speaker Stage to hear more from Chris Elliott, Senior Economist, Restaurants Canada.