A Data Deep-Dive on Foodservice Delivery and Takeout in Canada

For the hospitality industry, delivery and takeout have proved to be an important lifeline to surviving the economic impact of COVID-19. Though regulations are constantly fluctuating, at this time, Montreal, Quebec City, and the Chaudière-Appalaches region have entered a second lockdown, as has Toronto and Manitoba. Because of this, delivery and takeout will once again become critical for on-premise businesses trying to survive. While the shutdown of dine-in may not last forever, the only consistency we can depend on is the fact that guidelines will change – which means that the importance of delivery and takeout cannot be understated.

The growing importance of delivery revenues – a result of bars and restaurants rapidly pivoting their operations – has also been supported by changes in legislation allowing the delivery of alcohol. According to on-premise consultancy CGA Nielsen, in April, 44% of Canadian consumers said they were ordering takeout/delivery, with 16% also ordering alcohol. Over the last three months, this number has rocketed to 31%. As Canadian provinces begin to reinforce stricter lockdown measures, it’s expected that these numbers will only continue to increase – a trend already observed in the US.

In the states, CGA Nielsen has been tracking consumer behaviour around takeout and delivery since April, revealing that the appetite for delivery and takeout has grown: in April, 62% of US consumers were ordering food for delivery in the prior two weeks, with 9% ordering alcohol. Come September, these numbers increased to 65% and 11% in the last two weeks respectively, despite bars and restaurants reopening across the country.

Delivery Motivators

The factors motivating Canadian consumers to order alcohol for delivery centres largely around safety and convenience. CGA Nielsen’s Canadian On-Premise User Survey (OPUS) revealed that 39% of surveyed consumers order alcohol to avoid entering a grocery or liquor store. 30% also said it was more convenient to get alcohol with their takeout or delivery.

As stricter lockdown measures increase, these two factors will again be at the forefront for consumers, alluding to a potential increase in delivery demand. As expected, factors such as safety will take precedence, however, CGA Nielsen’s data shows that consumers are also concerned about supporting local business: 17% of consumers said they ordered delivery and takeout to do just that.

Of those who have ordered alcohol for delivery, 50% have ordered directly from the bar or restaurant, vs 44% on a food delivery app and just 15% on an alcohol delivery app – a positive sign for establishments facing further challenges.

Venue Insights

Despite the looming impact of provincial lockdowns, CGA Nielsen’s data reveals another silver lining, particularly for restaurants. Out of seven on-premise channels, the top three venues for ordering alcohol for delivery are in fact restaurants, with independent restaurants leading at 33%, followed by casual dining chains (25%) and ‘other’ restaurants (22%).

The top three are then followed by bars, with neighbourhood bars at number four (21%), followed by sports bars (17%), brewery taprooms (13%) and wine bars (11%).

This would suggest the unique appeal of restaurants for ordering alcohol for delivery, potentially due to their adapted approach and ability to provide both food and drink in a single order.

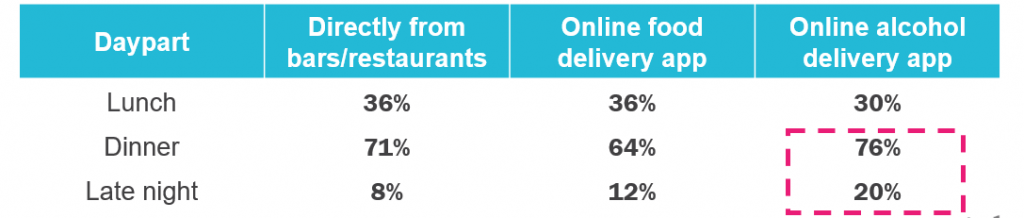

Daypart Insights

Diving deeper into the results of the survey, CGA Nielsen’s data also revealed that dinner and lunch are the most popular times to order take out / delivery alcohol. At lunchtime, 36% of those surveyed said they ordered directly from bars/restaurants, increasing to 71% at dinner time. In the late-night daypart, the frequency of online alcohol delivery via restaurants and bars drops to just 8%, with online alcohol delivery apps leading at 20%.

To maximize opportunity, bars and restaurants may need to focus on marketing their lunch and dinner offers in order to retain and grow these dayparts, while strategizing around late-night offers to compete with apps.

The Categories Driving Revenue

Of the 12 categories in the Canadian On-Premise User Survey, beer and wine are the most popular choices for takeout and delivery, with 29% of consumers ordering domestic beer and 29% ordering red wine. This is followed by imported beer (26%), white wine (25%), craft beer (24%), and spirit and mixers (21%).

Looking at cocktails, 15% of consumers have ordered pre-made cocktails and 14% have ordered cocktail kits. While relatively low in comparison to beer and wine, several consumers said they would consider pre-made cocktails (40%) and cocktail kits (42%), highlighting a potential opportunity for bars and restaurants as restrictions increase.

The

average delivery spend on alcohol also highlights which categories drive the

most value and echoes the potential for cocktails:

What’s Next for Delivery?

Above all else, CGA Nielsen’s Canadian On-Premise User survey reveals the clear appetite for alcohol delivery and the value it can provide to Canadian establishments facing difficulties in the face of COVID-19. As provinces across the country begin to reimpose restrictions, a sound delivery and takeout strategy is key.

Commenting on the opportunity for bars and restaurants, CGA Nielsen’s Client Solutions Director, Matt Crompton said: ‘Delivery has been a real saving grace for many restaurants and bars in their attempts to stay afloat during such a challenging year. Delivery of alcoholic beverages can enhance this opportunity even further and our data shows that the appetite from consumers is well and truly there. With the winter months just around the corner, it is absolutely vital that restrictions remain lifted so that On-Premise retailers can maximize every $ spent via delivery.’

The results of the next Canadian On-Premise User Survey (OPUS) will be released this October. To learn more, contact Nielsen CGA at hello@nielsencga.com.

SOURCE: Nielsen CGA Canada On Premise User Survey (April 2020)

1 Comments